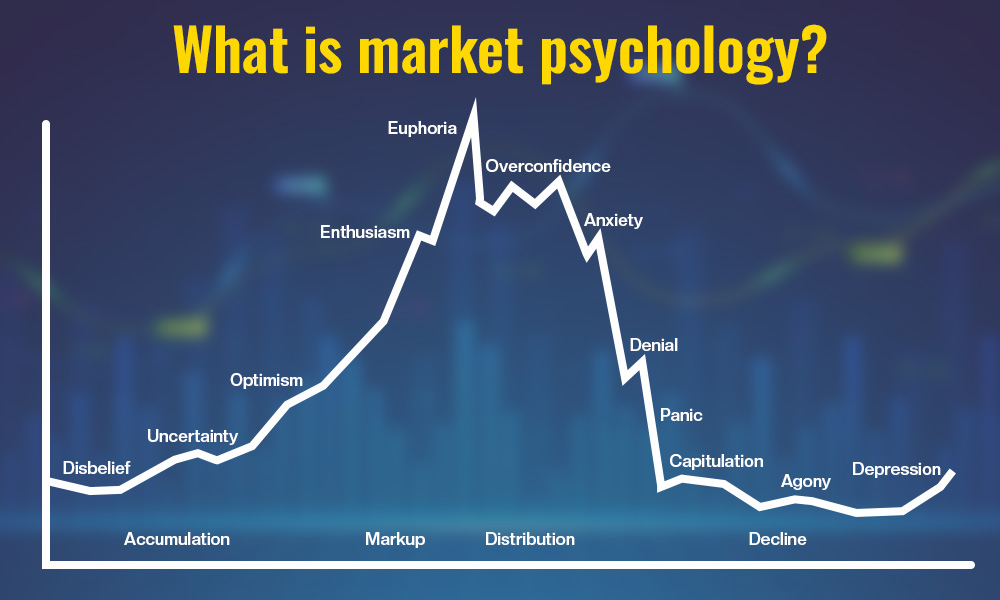

The stock market isn’t just driven by earnings reports and economic indicators—it’s also deeply influenced by human psychology. Behavioral finance explains how fear and greed can drive stock prices, causing market booms and busts. Understanding these psychological forces can help investors make smarter, more rational decisions and avoid costly emotional mistakes.

In this post, we’ll explore the role of psychology in investing, how emotions affect market trends, and key strategies to maintain a level-headed approach to investing.

Stock Types

- Common Stocks: These have voting rights and signify ownership in a business. They are the kind of stock that is traded the most.

- Shareholders Stock: who own preferred stocks have a greater claim on assets and profits, including the ability to receive dividends ahead of common stockholders. Preferred stockholders, however, usually do not have the ability to vote.

How Fear and Greed Influence the Market

Two of the most powerful emotions in investing are fear and greed. These emotions often lead to irrational market behavior, creating bubbles, crashes, and volatility.

1. Greed: The Driving Force Behind Market Bubbles 📈

When stock prices are rising, investors often become overly optimistic and rush to buy, fearing they’ll miss out on further gains. This “fear of missing out (FOMO)” leads to overvaluation and speculative bubbles. Examples include:

- Dot-com bubble (1990s-2000s): Investors poured money into internet companies with no profits, driving stock prices to unsustainable levels.

- Bitcoin surge (2017, 2021): Speculative buying led to rapid price increases, followed by sharp corrections.

2. Fear: The Catalyst for Market Crashes 📉

Fear can cause panic-selling, often leading to sharp market declines. When investors see falling prices, they rush to sell, further driving the market down. Notable examples include:

- 2008 Financial Crisis: Fear of collapsing financial institutions triggered a massive sell-off.

- COVID-19 Market Crash (2020): Uncertainty over the pandemic led to one of the fastest market drops in history.

Behavioral Finance: The Science Behind Market Psychology

Behavioral finance explains how cognitive biases influence investment decisions. Here are some common biases that impact investors:

1. Loss Aversion ⚖️

Investors tend to feel the pain of losses twice as strongly as they feel the joy of gains. This can lead to irrational decisions, such as holding onto losing stocks too long, hoping they’ll recover.

2. Herd Mentality 🐑

People often follow the crowd, buying when others are buying and selling when others are selling. This contributes to bubbles and crashes.

3. Overconfidence Bias 💡

Many investors believe they can “beat the market,” leading to excessive risk-taking and poor decision-making.

4. Confirmation Bias 🔍

Investors seek out information that supports their existing beliefs and ignore data that contradicts them. This can lead to misguided investment choices.

Psychological Tricks to Avoid Emotional Investing Mistakes

To become a more disciplined investor, use these psychological strategies:

1. Have a Long-Term Plan 📅

- Set clear investment goals and stick to them.

- Avoid making decisions based on short-term market fluctuations.

2. Use Dollar-Cost Averaging 💰

- Invest a fixed amount at regular intervals, reducing the impact of market volatility.

- Prevents panic-buying or selling based on emotions.

3. Diversify Your Portfolio 📊

- Spread investments across various asset classes to minimize risk.

- Reduces emotional reactions to single-stock volatility.

4. Limit Media Consumption 📰

- Financial news often fuels fear and greed.

- Focus on long-term trends rather than daily headlines.

5. Follow a Pre-Set Exit Strategy 🚪

- Decide in advance when to sell a stock based on logic, not emotion.

- Use stop-loss orders to limit potential losses.

Table Of Content

Final Thoughts

The stock market is a complex system influenced not just by the economic data but also by human emotions. Understanding behavioral finance can help investors control fear and greed, leading to smarter, more profitable decisions.

By developing a disciplined investment strategy, sticking to a plan, and avoiding psychological traps, investors can navigate market fluctuations with confidence.

What’s the biggest emotional challenge you face when investing? Share your thoughts in the comments below!